Unit prices will soon outstrip houses according to surprise new real estate predictions. Experts say the Gold Coast, Townsville and Cairns could soon overtake Brisbane for property growth.

Housing Market Shake-Up: Units Set to Dominate

The Australian housing market is on the brink of a significant transformation, as units are poised to assert their dominance in the real estate landscape. In this article, we explore the latest forecasts and trends that indicate a shift in buyer preferences towards units in major cities.

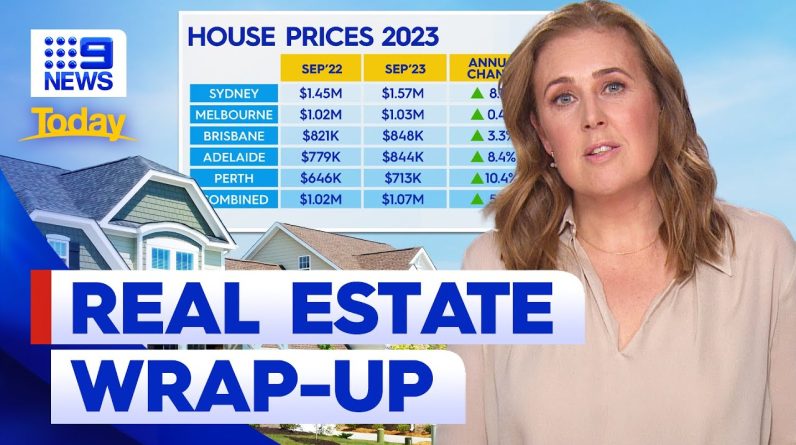

With unit prices projected to outpace house prices in key urban centers such as Sydney, Brisbane, Adelaide, and Melbourne, experts attribute this change to factors like comparatively lower prices, reduced borrowing capacities and evolving buyer preferences.

However, there’s more to this story than meets the eye. As we delve deeper, we’ll uncover the specific cities most impacted, the factors influencing the market, and the potential implications for upgraders and high-income earners. So, let’s unravel this housing market shake-up together and navigate through the complexities that lie ahead.

Key Takeaways

- Unit prices in Sydney, Brisbane, Adelaide, and Melbourne are forecasted to grow faster than house prices.

- Perth is expected to experience a significant jump in unit prices by 8.5%.

- National unit prices are projected to accelerate to 7.6% growth in FY25 and FY26.

- The cheaper price of units compared to houses may drive growth in the unit market, as buyer preferences shift due to reduced borrowing capacities.

Capital City Forecasts

Capital city forecasts indicate a positive outlook for the housing market, with several cities expected to experience strong price growth in the coming years. According to the forecasts, Perth is predicted to see a significant surge in house prices, with a projected growth rate of 9.3% in 2024. This growth is attributed to factors such as affordability, a strong economy and a housing shortage.

As well, Perth, Adelaide, and Brisbane are expected to remain the strongest performing markets. The imbalance of supply and demand in 2024 is also expected to drive strong price growth in these cities. Low levels of listings and affordability in Perth, Brisbane and Adelaide are likely to prop up prices, while Western Australia’s population growth and low unemployment rate will boost demand in Perth.

Unit Prices Forecast

Unit prices are projected to experience significant growth in several major Australian cities, outpacing house prices, according to the latest forecasts. In Sydney, Brisbane, Adelaide, and Melbourne, unit prices are expected to grow faster than house prices. Perth, in particular, is anticipated to see a jump of 8.5% in unit prices.

The national forecast also predicts that unit prices will accelerate to a 7.6% growth in the fiscal years 2025 and 2026. The affordability of units compared to houses is expected to be a driving factor behind this growth. Additionally, buyer preferences may shift towards units due to reduced borrowing capacities.

This forecast indicates a potential shift in the housing market, with units set to dominate in terms of price growth.

Upgraders and High-Income Earners

In the real estate market, upgraders and high-income earners play a significant role in influencing property prices and market dynamics. While the overall growth in the market is predicted to slow down in 2024, these particular buyers may have a positive impact on property prices. Cashed-up upgraders who have gained equity in recent years could support prices, as they have the financial capacity to invest in higher-priced properties.

Furthermore, the implementation of stage three tax cuts may boost the market in the second half of the year, potentially stimulating demand from high-income earners. Additionally, buyers with large deposits, who are more insulated from higher interest rates, may increase their upgrading activity, further contributing to elevated prices. Therefore, these factors suggest that upgraders and high-income earners will continue to shape the housing market in the coming year as house owners renovate and value to their houses.

Forecast for Specific Cities

Adelaide’s housing market is expected to continue its strong growth trajectory in the coming year, with house prices projected to increase by nearly 4% in 2024. This growth can be attributed to the city’s affordability and limited supply, which drove house prices up by almost 11% in 2023.

Meanwhile, Brisbane is expected to record the second-fastest house price growth behind Perth, with values jumping 3.9% in 2024. On the other hand, Sydney’s affordability worsens, resulting in a modest house price growth of just 1% in the same year. Melbourne, too, is expected to remain relatively flat with a growth rate of 0.7% in 2024, although growth may accelerate in the following years.

Factors Affecting the Market

Several factors have the potential to influence the housing market in the coming year. Higher mortgage and living costs, rising unemployment, and a potential increase in stock may curb growth in 2024. However, the implementation of stage three tax cuts may boost the market in the second half of the year.

Another factor to consider is the share of buyers with large deposits, which has almost doubled since the pandemic. This could potentially support prices as these buyers are more insulated from higher interest rates.

It is important to note that the information published is of a general nature and does not consider personal objectives or financial situations. Therefore, independent advice is recommended before acting on the content.

Frequently Asked Questions

What Are the Factors Contributing to the Strong Price Growth in Perth, Adelaide, and Brisbane?

Factors contributing to strong price growth in Perth, Adelaide, and Brisbane include affordability, a strong economy, housing shortage, low levels of listings, population growth, low unemployment rate, and buyer preferences shifting towards units due to reduced borrowing capacities.

How Does the Imbalance of Supply and Demand Affect the Housing Market in the Best Performing Cities?

The imbalance of supply and demand in the best performing cities affects the housing market by driving strong price growth. Low levels of listings and affordability, along with population growth and low unemployment rates, contribute to the high demand for housing.

Why Are Unit Prices Forecasted to Grow Faster Than House Prices in Certain Cities?

Unit prices are forecasted to grow faster than house prices in certain cities due to factors such as the cheaper price of units compared to houses, reduced borrowing capacities, and a potential shift in buyer preferences towards units.

What Are the Reasons for the Slower Growth Predicted for Upgraders and High-Income Earners in 2024?

The slower growth predicted for upgraders and high-income earners in 2024 is attributed to higher mortgage and living costs, rising unemployment, and a potential increase in stock. However, the implementation of stage three tax cuts may boost the market in the second half of the year.

How Does the Implementation of Stage Three Tax Cuts Potentially Impact the Housing Market in the Second Half of the Year?

The implementation of stage three tax cuts in the second half of the year may potentially boost the housing market. This could lead to increased activity from buyers with large deposits and potentially support property prices.

Albion News is a great place to find informative, up-to-date news articles. We provide a wide range of unique articles that offer an interesting perspective on current events from around the world and from various different sources. You can easily search for the topics that matter most to you and explore in-depth pieces that provide insight into the issues and important debates occurring today. Albion News helps you stay informed with carefully researched and credible stories!