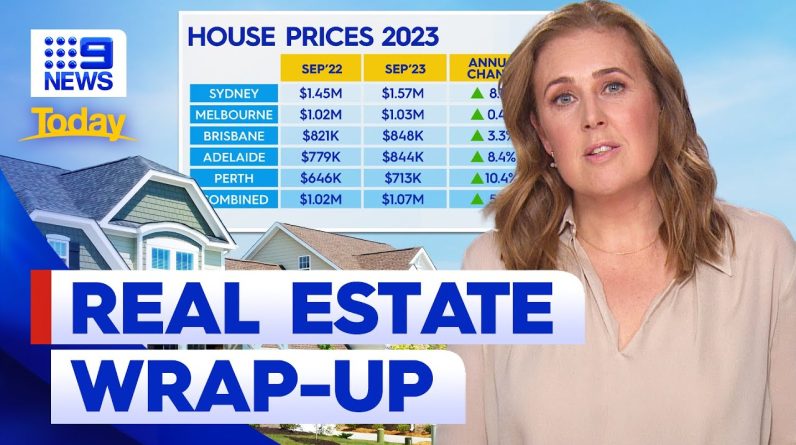

New data has found steep climbs in interest rates have not curbed the growth of Australia’s housing market, with Sydney in particular facing a steep climb in property prices.

Australian Property Market: A 2024 Outlook

As we move through 2024, the Australian property market is showing signs of resilience and growth despite various economic challenges. According to recent reports, property prices are expected to rise by as much as 5 percent this calendar year. This article delves into the factors driving this growth, the outlook for different regions, and the potential impact of economic conditions on the market.

Current Market Trends

Rising Property Prices

Nationally, property prices have risen by 5.9 percent over the financial year to date (FYTD). This upward trend is expected to continue, with forecasts suggesting an additional increase of 2 to 5 percent in the 2024-25 financial year (FY25). Several factors are contributing to this growth:

- Strong Buyer Demand: Despite interest rates being at 12-year highs and borrowing capacities falling, buyer demand remains robust.

- Elevated Immigration Levels: Increased immigration is supporting market demand, as more people seek housing solutions in Australia.

Regional Variations

While overall property prices are climbing, growth rates vary across different regions. Here are some key projections:

- Perth: Expected to lead home price growth in the coming financial year.

- Adelaide: Home prices are anticipated to grow by 5 to 8 percent in FY25.

- Melbourne: The property market here is seeing relatively subdued price growth due to lower rental yield returns for investors.

Economic Influences

Interest Rates and Inflation

Economic conditions play a significant role in shaping the property market. Currently, the Consumer Price Index (CPI) indicator has risen to 4 percent in the 12 months to May 2024. While rent inflation slightly decreased from 7.5 percent to 7.4 percent, the cost of new dwelling purchases by owner-occupiers remained steady at 4.9 percent over the same period.

Several economists have warned that higher inflation numbers could prompt an interest rate hike by the Reserve Bank of Australia (RBA). The ANZ Bank has delayed its forecast for the RBA’s first interest rate cut from November 2024 to February 2025. Meanwhile, Deutsche Bank predicts that the RBA will hike interest rates at its next board meeting in August.

Borrowing Capacities

With interest rates at their highest levels in over a decade, borrowing capacities for potential buyers have diminished. Despite this, the volume of stock for sale in the market has increased, suggesting that sellers are confident in the current market conditions.

Future Prospects

Nominal Home Prices

Nominal home prices are expected to grow by 4 to 6 percent in 2024. This growth indicates a healthy level of activity and optimism in the property market, even as external economic pressures persist.

Regional Leaders

Perth and Adelaide are likely to be the standout performers in terms of price growth over the next financial year. These regions are benefiting from strong local economies and attractive living conditions, drawing both domestic and international interest.

Conclusion

The Australian property market is poised for continued growth in 2024, driven by strong buyer demand, elevated immigration levels, and regional economic strengths. However, potential interest rate hikes and ongoing inflation concerns could influence the market landscape. As always, staying informed and working with experienced real estate professionals can help buyers and sellers navigate these dynamic conditions successfully.

Real estate agents play a crucial role in navigating the complexities of buying or selling a property. They offer invaluable expertise, whether it’s through market analysis, negotiation skills, or seamless transaction management. By leveraging their local knowledge and professional networks, real estate agents can significantly enhance your property journey, ensuring you secure the best deals and avoid common pitfalls. For a deeper dive into how these professionals can benefit you, read the full article.

Read more here: https://www.abc.net.au/news/2024-06-27/rba-to-hike-in-august-says-investment-bank-property-prices-rise/104026844

Albion News is a great place to find informative, up-to-date news articles. We provide a wide range of unique articles that offer an interesting perspective on current events from around the world and from various different sources. You can easily search for the topics that matter most to you and explore in-depth pieces that provide insight into the issues and important debates occurring today. Albion News helps you stay informed with carefully researched and credible stories